Visa is testing AI agents that automatically shop for you

Visa 'Intelligent Commerce' is taking the next step in online shopping

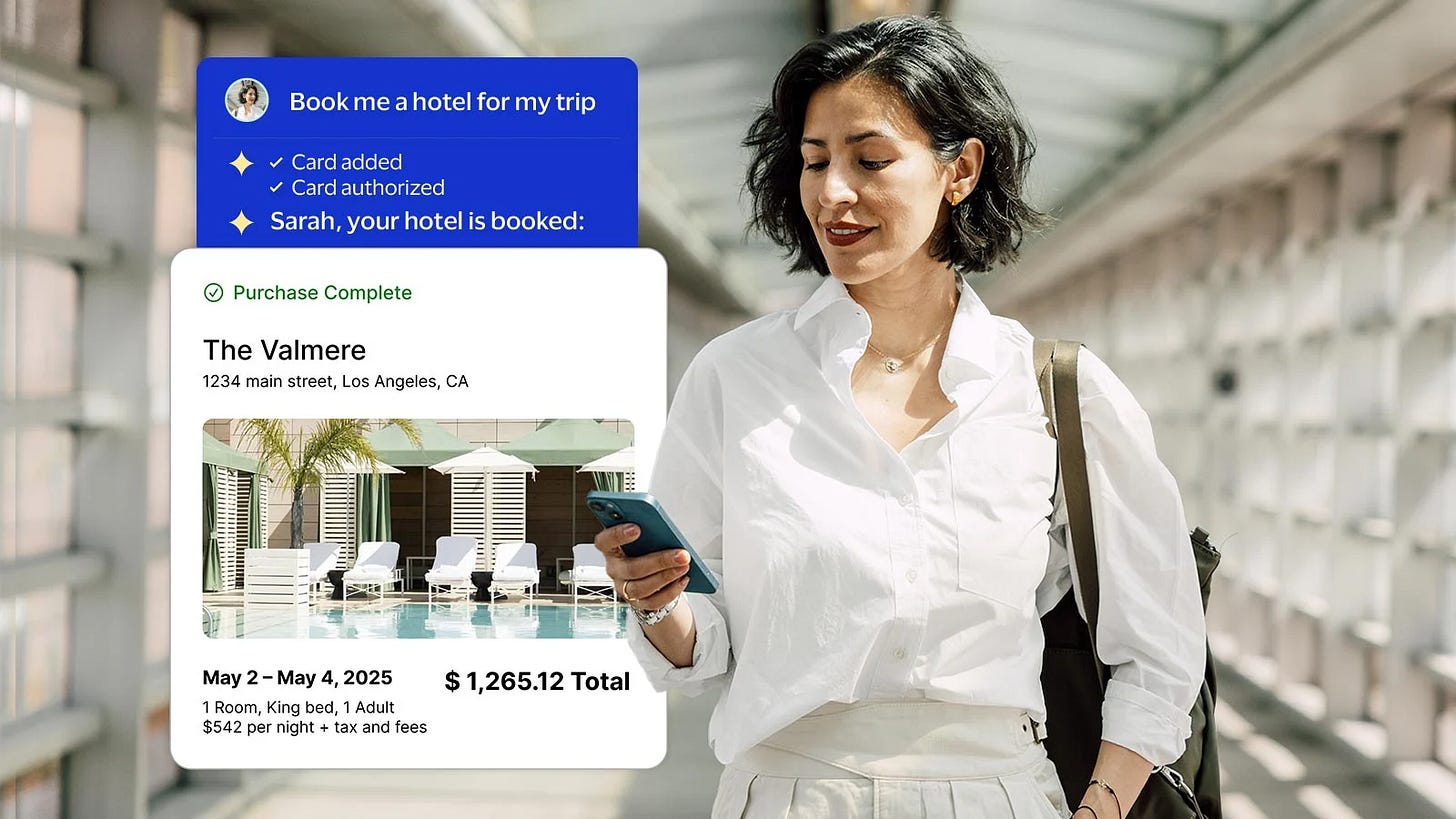

💳 Visa is testing AI that executes desired shopping purchases

🧠 AI agents are the next step in AI, beyond simply curating results

🛍️ Want to book (not just find) a flight at a specific price drop or pre-order a Nintendo Switch 2 before it goes away?

🔐 AI agents would work within thresholds and use the same verifications and tokenization protections as current credit cards

🏦 14,000 bank partners worldwide could work with Visa to ensure its AI ambitions are secure, Visa’s Mark Nelsen told The Shortcut

🤖 AI agents could handle as much as 20% of all e-commerce tasks in a year

What if your AI assistant doesn’t just recommend a flight for an upcoming trip, but pays for it on your behalf?

“Welcome to the future of possible,” teases Visa CEO Ryan McInerney, shortly after taking the stage at Visa’s Product Drop press event in San Francisco.

Powered by “agentic transactions,” Visa officially took the wraps off its ambitious Visa Intelligent Commerce initiative, a suite of tools and technologies to facilitate AI-based shopping.

With your consent, Visa partners like OpenAI could work with AI agents to research, select, and even buy that flight for you. You could even set parameters, such as a price threshold (if the fare drops below, say, $400, you’re all in), plus no stopovers or redeyes.

Until now, AI agents have been able to curate personalized recommendations for products and services, but they stop short in transacting with merchants.

This is the full-circle solution Visa is aiming to provide.

“Today, when your AI agent displays your itinerary, makes all kinds of recommendations for you, restaurants and excursions, it’s pretty magical,” says McInerney, in a hypothetical scenario for an upcoming trip.

“I'm going say ‘this looks fantastic, love it, so let’s book it’ and then my agent is going to tell me ‘I'm sorry I'm not fully trained to make payments for you, but I could direct you to websites where you can make these purchases,’” continues McInerney. “This is where all the fun currently ends, but it’s actually a pretty solvable problem: we could give AI agents payment tools.”

If done right, this could free up a lot of time and hassle.

Trust is a key issue

Given its decades-long reputation for secure payments, a company like Visa has the potential to make agentic commerce a reality, as it’s trusted by consumers, sellers, and banks.

After all, Visa’s network has processed more than 3.3 trillion transactions over the past 25 years, evolving from brick-and-mortar shopping to online retail and then mobile and social commerce, to the promise of agent-driven AI purchases.

🍕 Fun fact: Visa processed the first e-commerce transaction back on August 11, 1994. It was a pepperoni pizza.

“Visa Intelligent Commerce provides a missing link in the AI commerce experience,” believes Jordan McKee, Research Director with Boston-based 451 Research. “Trusted, recognizable providers, like Visa, are needed to bring AI-powered commerce to life at scale.”

“Success will be dependent on ecosystem-wide collaboration, but Visa’s launch is a critical building block for the industry to start from,” adds McKee.

So, how would Visa’s AI work?

Essentially, your Visa card will be securely stored and used once you review the details and the AI agent approves the transaction.

“There will be a one-time setup for Visa customers to allow the agent to buy on your behalf,” clarifies Mark Nelsen, Global Head of Consumer Products at Visa, in an interview with The Shortcut. “With the help of our more than 14,000 bank partners around the world, we’re going to verify it’s you, and then you’ll be good to go.”

And yes, the same credit card protections you enjoy today with retail and online shopping, such as tokenization and authentication, remain the same in the era of agentic commerce.

“Tokenization” replaces your real Visa number with a randomly generated and encrypted code, so your private data isn’t disclosed. Authentication is moving to more convenient biometrics-based “passkeys,” such as using your face to uniquely identify you.

“Even as the technologies evolve and buyer and seller preferences evolve, our goal hasn't changed, which is to connect buyers and sellers through seamless, secure digital payments,” McInerney asserts.

“I want to emphasize the protection of data privacy, consent and control of your data -- all of this is very important to us,” reiterates McInerney.

“We're not sharing any raw user data, your transaction data remains private, and you get to decide which provider can access any of your insights, your preferences, and can stop sharing at any time,” he adds.

When will Visa Intelligent Commerce be available?

According to Nelsen, we should see the start of Visa-led agentic commerce “in the next couple of months.”

“We have a number of partners now that are coding to the APIs, they're in our sandbox and testing, and it’s going well,” adds Nelsen.

Along with OpenAI, Visa announced a few additional agentic commerce partners at its Product Drop, including Perplexity, Microsoft, Anthropic, Samsung, IBM, Stripe and Mistral AI, Europe’s largest AI company.

It should be noted that other tech heavyweights are dabbling with agentic commerce, too. On April 3, Amazon announced it was testing an AI-powered service, dubbed Buy for Me, which lets customers purchase items from brands at other sites, while remaining in the Amazon Shopping app. Depending on the product, AI will shop the brand site for you and send you a note to approve the purchase, or you may be prompted to visit the brand’s site directly. It’s currently free, but only available to some of Amazon’s existing US customer base.

AI agents could handle as much as 20% of all e-commerce tasks within a year, predicts Paul van der Boor, Vice President of AI at technology investment firm Prosus, according to an interview with PYMNTS, a publication that centers on payments and payment technologies.

Other fintech news from Visa’s Product Drop

Visa also discussed other new and expanded fintech services, to help deliver its promise of seamless payment experiences, everywhere.

A few highlights:

Stablecoins: Visa and startup Bridge, a Stripe company, are partnering to offer stablecoin-linked Visa cards to customers across multiple countries, beginning in Latin America. This will allow users to make everyday purchases via cryptocurrency tokens. (As the name suggests, stablecoins are a type of cryptocurrency designed to maintain a constant value.). Visa has also partnered with crypto company Baanx to launch stablecoin cards tied to self-hosted wallets in the US.

Flex Credential: Last year, Visa introduced the aptly-named Flex Credential, a next-gen payment card and app that can seamlessly toggle between different payment methods, such as debit, credit, and “buy now, pay later.” Visa and payment service Klarna are partnering to bring the Flex Credential to the US.

Visa Pay: Set for beta release in parts of Asia, Europe and Latin America, Visa Pay is a new service that connects any participating wallet to any Visa-accepting merchant -- local or international, in-store or online. Visa says almost 4 billion people around the globe use mobile wallets today. The first four partners will be Line Pay, Zallopay, maya, and Woori Card.

Visa Accept: Most micro-sellers around the world, such as a painter selling their wares on the streets of Venice, do not have the ability to accept Visa cards. Visa Accept aims to change that. It will allow merchants with any NFC-capable smartphone to accept Visa payments from shoppers. It’s set to launch in July, in Latin America and Asia.