Apple launches new high-yield Savings account as it takes aim at banks

The company announced a new Savings account for Apple Card users is available in the US

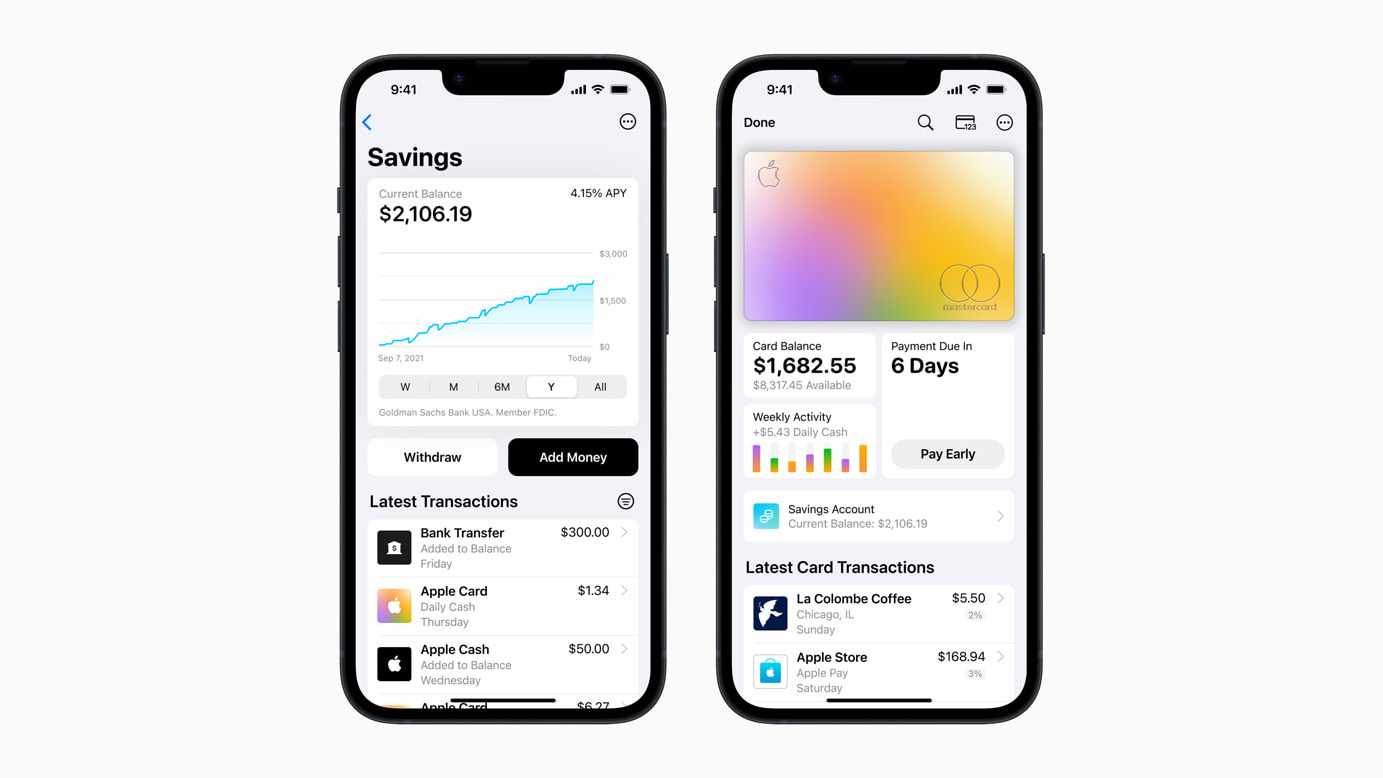

Apple has launched a new Savings account that offers a high-yield APY of 4.15%. The Savings account is from Goldman Sachs and is available to Apple Card users in the US.

The APY of 4.15% is more than 10 times the national average, according to Apple, and includes no fees, no minimum deposits, and no minimum balance requirements.

Users can also easily set up and manage their Savings account directly from Apple Card in Wallet.

➡️ The Shortcut Skinny: Apple Savings account

💰 Apple has launched a new Savings account in the US

📈 It offers a high-yield APY of 4.15%

🤑 That’s 10 times more than the national average, according to Apple

🚫 You won’t be hit with any fees, minimum deposits or minimum balance requirements

In a statement on Apple Newsroom, Apple’s vice president of Apple Pay and Apple Wallet Jennifer Baily said: “Savings helps our users get even more value out of their favorite Apple Card benefit – Daily Cash – while providing them with an easy way to save money every day.

“Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly – all from one place.”

After you’ve set up a Savings account, all future Daily Cash you earn will be automatically deposited into the account. There’s no limit on how much Daily Cash you can earn, and the destination can be changed at any time.

Not sure what Daily Cash is? Well, when you buy something with Apple Card, you get a percentage of your purchase back in Daily Cash. You can find how much Daily Cash you’ve earned from Apple Card purchases in the Wallet App and by tapping on Apple Card.

You also deposit more funds into your Savings account through a linked bank account or from your Apple Cash balance.

Whenever you want to check access your Savings dashboard, head to Apple Wallet and you can see your balance and interest earned over time. You can withdraw funds at any time through the dashboard to a linked bank account or to your Apple Cash card with no fees.

It’s frustrating that Apple Card and the new Savings account are exclusive to the US. As someone who regularly uses Apple Pay and has a variety of Apple products, it would be nice to benefit from the convenience that Apple Card offers.

Hopefully it won’t be too long before Apple rolls out its suite of financial offerings overseas.